eID technology offers numerous benefits for individuals and businesses alike. Taking full advantage of them requires a national eID infrastructure that meets cross-industry interoperability standards. The goal is an eID solution that serves as an interface to both private sector services and e-government services. OeNPAY aims to lay the foundation for such a comprehensive eID infrastructure in Austria in cooperation with all stakeholders.

OeNPAY ran the “e-IDentify yourself” OeNPAY Electronic Identity Challenge for three months to crowdsource ideas for brilliant, new eID applications that transcend the range of existing solutions and can be used in all walks of life. The idea contest aims to contribute to developing a comprehensive, interoperable eID infrastructure and to promote digitization in Austria and Europe in cooperation with all stakeholders.

“OeNPAY serves as a catalyst for innovation and bridges the gap between private and public market participants. Our goal is to promote a common, cross-industry solution and get people engaged in the process. We received a large number of contest submissions that highlight the broad range of potential eID applications in all walks of life. Implementing these applications is the next step to unlocking their potential at the national and international level.”

Franz Deim, Managing Director, OeNPAY Financial Innovation HUB GmbH

The winning entry, a secure, modular metaverse identity, was selected by a distinguished jury of experts from the innovation community, and the winner was awarded EUR 3,000 in prize money. The idea is to provide users with a secure electronic identity in the digital sphere, but without them having to divulge too much personal information.

“The metaverse (web 3.0) offers countless, virtually untapped innovation opportunities across different sectors. The winning idea of our contest advocates for developing new, secure solutions that prevent attacks on the user’s financial assets and identity data in cyberspace.”

Bernhard Krick, Managing Director, OeNPAY Financial Innovation HUB GmbH

„We found the idea especially inspiring – it was the most forward-looking of all entries. The metaverse is an emerging megatrend that has the potential to fundamentally change the way we live and work. It also has the potential to reshape payments from the ground up. This is why we found the idea so compelling.”

Joint jury statement

“We have seen how efficient cooperation of private and public sector providers helps spark the development of sound eID solutions. We of OeNPAY see ourselves as a catalyst of innovation, and we aim to bridge the gap between private and public market participants. Our goal is to promote a common, cross-industry solution and get people engaged in the process.”

Franz Deim, Managing Director, OeNPAY Financial Innovation HUB GmbH

“In our society, commercial activities, daily tasks and social connections are increasingly based on digital data. No matter if we are shopping, banking, driving a car, taking a vacation, working, doing leisure activities, making a phone call or spending time on social media: All these activities involve the processing of our personal data. Protecting the personal reference, our electronic identities, the data themselves and how they are processed is therefore becoming increasingly important.”

Kurt Einzinger, Data Protection Officer, Member at Austrian Data Protection Council

“Today, consumers manage 29 user profiles on average, which means they have to memorize several different login data. That is not just annoying – given the large number of profiles, users can easily lose track of who has what personal data. We need eID solutions that give people full control over their data at the highest security level, that can be used with applications in all areas of life. A case in point is our ich.app. This is why we are very much looking forward to learning about exciting new ideas put forward by users and market participants and exploring promising cooperation opportunities. The success of an eID solution in Austria and in Europe will hinge on its interoperability and range of potential applications.”

Harald Flatscher, Geschäftsführer, PSA Payment Services Austria

“Improve society with technology”

Andreas Freitag, Consultant für Blockchain, DLT & Self Sovereign Identity, trusinity

“Digital identities are an integral feature of our digitized working and living environments. They stand for convenience, efficiency and time and cost savings. Too many online applications still rely on low-security authentication methods, such as a user name and password. Secure digital identities are essential to unlocking the potential of digitization.”

Robert Jeller, Abt. Innovation und Digitalisierung, Wirtschaftskammer Österreich (WKÖ); Vorsitzender des Beirats A-Trust

“Digitization is happening at a fast pace in all spheres of life. Digital processes are becoming increasingly important for individuals, businesses and public authorities. Protecting one’s own digital identity is especially relevant in online transactions. We are on the lookout for fascinating eID applications that make life easier, more efficient and more secure without compromising user privacy.”

Bernhard Krick, Managing Director, OeNPAY Financial Innovation HUB GmbH

“Trust is essential to online transactions. Digital identities allow you to know who you are communicating with. Today, we are still exploring the range of possible applications. As a member of the jury for the OeNPAY Electronic Identity Challenge, I look forward to the presentation of innovative ideas on how digital identities can make the online world more secure and add variety, while at the same time respecting people’s right to privacy.”

Herbert Leitold, Director-General, Secure Information Technology Center Austria A-SIT

“A unique identity allows extending the rule of law to the Internet in an effective manner.”

Hartmut Müller, CEO, Notartreuhandbank AG

“The OeNB advocates for more competition, transparency and European autonomy with respect to payment systems. An important component of this endeavor is the digitization of identities. I look forward to learning about innovative ideas and approaches that will take us a step closer to this goal and to exploring cooperation opportunities between market participants and public institutions.”

Petia Niederländer, Director Payments, Risk Monitoring and Financial Literacy Department, Oesterreichische Nationalbank

“My wish is a context-sensitive eID that just provides access to the data required in a given situation.”

Katja Schechtner, Senior Urban Scientist and Advisor for Innovation & Technology, Visiting Professor University of Applied Arts Vienna; Research Affiliate MIT

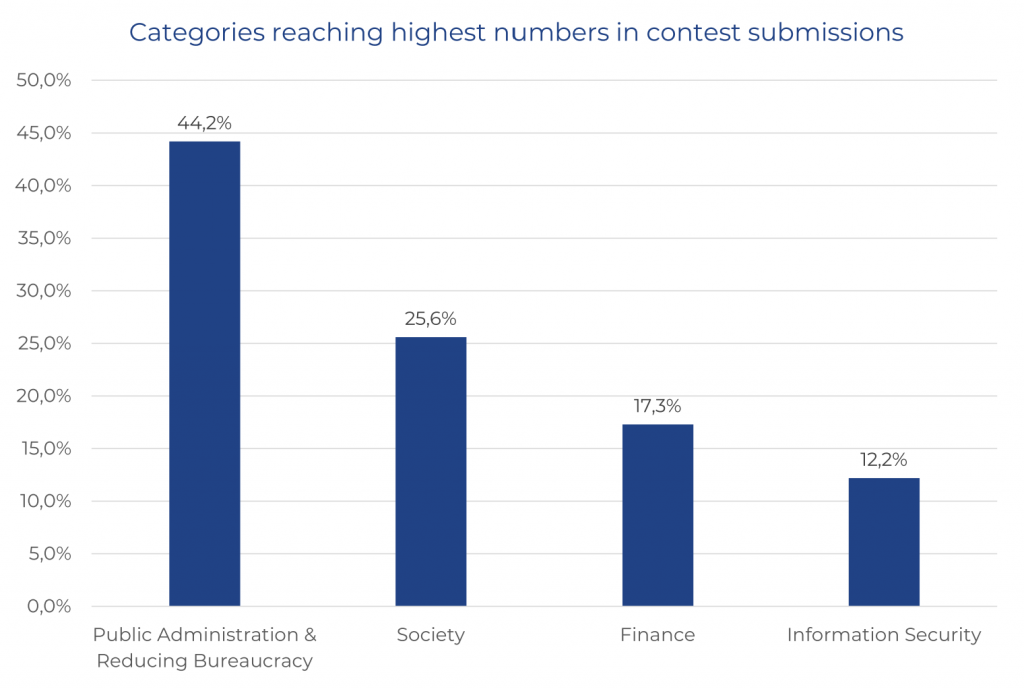

The large number of contest submissions highlights the broad range of potential eID applications in all areas of daily life. Our contest participants recognized that the demand for digital identity solutions is greatest in public administration and for reducing bureaucracy. A case in point is EASY ID, a contest entry that simplifies the processing and sharing of a user’s address, bank details or ID card. Another entry, entitled “e-ID proves your knowledge”, focuses on the submission of education certificates. The contest entries cover many areas of daily life, with public administration and reducing bureaucracy accounting for the largest share (44 %), followed by society (26 %), finance (17 %) and information security (12 %).

Source OeNPAY: Most of the ideas came from these four categories. Multiple allocations possible.

Identity verification plays an important role in our day-to-day lives, as it allows us to prove who we are. This is what passports or identity cards are for. Now the identity verification process has gone digital thanks to modern technology: People can use digital ID solutions to access public and other services where they once had to show up in person – it’s simple, fast and secure.

Electronic identity (e-ID) solutions enable individuals and businesses to provide digital proof of who they are. An e-ID issued by a certified provider serves as a legally valid, standardized electronic means of identification. It can be used to authorize transactions, to ensure the secure transfer of personal data and certificates, and to provide a legally binding digital signature.

Today, e-ID solutions are used in several fields. For instance, they are absolutely essential for electronic payments. Based on modern technologies and legally compliant, these e-ID solutions provide simple and secure access to digital financial services such as one-time payments, digital banking services or loan applications. e-ID solutions can be used for far more than that, though – they come in helpful in all digital interactions that require proof of identity.

A number of private and public sector organizations provide different types of e-ID solutions in Austria, but none of them is widely used for a broad range of applications. As a result, several national and international public and private sector e-ID solutions co-exist in the market. Many of them are neither interoperable nor do they meet uniform legal and security standards. Austria does not have a comprehensive cross-sector solution that individuals and businesses can rely on for different types of applications.

Easy to use: Once installed, the e-ID becomes a standard feature of people’s digital wallets and a constant companion – one single technology that offers numerous functions. For instance, the e-ID allows people to access government services online where they once had to go in person.

Interoperable: An interoperable e-ID infrastructure ensures that several e-ID solutions by different providers can co-exist in the market.

International: In line with the EU’s efforts to create a European digital identity, OeNPAY aims to help create a national e-ID infrastructure that is interoperable across borders, so that Austrian e-IDs are accepted in other EU countries and vice versa.

Secure: A comprehensive e-ID infrastructure conforms to GDPR standards and meets the requirements of the European eIDAS Regulation. It helps protect privacy, reduce crime and fraud, and protect against data misuse and identity theft.

Transparent and user-controlled: A comprehensive e-ID infrastructure allows users to control what happens to their data and which details they reveal about themselves.

Digitized: A national, interoperable e-ID infrastructure promotes digitization and adds to the country’s appeal as a business location.

The European Commission works on developing a legal framework (eIDAS 2.0) for a European digital identity. The digital wallet (EU Digital Identity Wallet) should serve as a means for people and companies to identify themselves for public and private services within the EU and to prove certain information.